philadelphia wage tax work from home

Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia. Because of COVID-19 she was required to work remotely after March 16 2020 and only worked in.

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

If companies allow employees to telecommute after pandemic restrictions are lifted workers must pay the wage tax regardless of whether they work from home or not.

. While Philadelphia residents are eligible for refunds of City Wage Tax if. Philadelphia levies a 34481 wage tax on people who work but dont live in the city. Nonresident employees who work in Philadelphia are not subject to the citys wage tax during the time they are required to work outside of the city because of the new coronavirus the citys.

Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent.

Non-residents who work in Philadelphia must also pay the Wage Tax. Workers can change their tax status and be exempt from the City of Philadelphias City Wage Tax of 34481 until June 30 2020 and 35019 beginning July 1 2020. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

Philadelphia nonresident employees are not subject to the citys wage tax for at-home work. For those who used to commute to work in Philadelphia there is yet another benefit to working from home besides saving time gas and tolls. Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481.

According to the Departments longstanding convenience of the employer rule nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer for example a nonresident employee who works from home. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia. City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia.

Tom Wolf you do not have to keep paying the city wage tax. 1 Rated Job Search App. Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax.

You must speak to your employer about changing your tax status. Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Here are links to what you need to apply for a Wage Tax Refund. Do I have to pay Philadelphia city wage tax if I work from home. With the pandemic forcing many people to work from home thousands in our area are no longer commuting to work.

Do I have to pay Philadelphia city Wage Tax if I work from home. New Jobs Posted Daily. Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross wages.

If you live outside the city and have been working from home because your company closed its Philadelphia offices under orders from Mayor Jim Kenney and Gov. Residents are subject to the tax regardless of where they work. If you did not or cannot change your.

Ad New Work From Home Positions Open. Heres everything you need to know about it. A better way to search for jobs.

On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. A corporation with physical presence is subject to corporate net income tax unless its activities are protected by PL. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

Normally Philadelphia non-residents employed in the city can get a wage tax. 86-272 which law prohibits a state from imposing a net income tax on income. Phillys wage tax is the highest in the nation.

2020 Philadelphia City Wage Tax Refunds for Non-City Residents Required to Work from Home Due to COVID-19. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. Search Millions of Job Listings.

PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. But if companies close Philadelphia offices or downsize and require workers to rotate in on assigned days nonresidents will not pay the wage tax when working remotely. Companies are Urgently Hiring for Remote and Work From Home Positions.

April 14 2020 716 AM. For those who in the past commuted to Philadelphia there is yet another benefit to working from home beyond saving time gas and tolls. The refund is allowable only for periods during which a non-resident employee was.

According to the Departments longstanding convenience of the employer rule nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer for example a nonresident employee who works from home. The responsibility for proper tax reporting falls on the individual employee. An Upper Makefield resident who was employed for 60000 by a Philadelphia-based business and required to work from home during the pandemic could save about 1500 over one year.

Ad ZipRecruiter - The Best Way to Start Your Job Search. Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office. Employers can stop withholding the.

Plus the 1 you contribute instead will be invested in local improvements.

Yahoo Finance On Twitter Low Income Housing Map Minimum Wage

We Are A Reputable Stable And Profitable Burger Franchise Become A Proud Zac S Burger Franchisee Today For Inf Catering Options Ultimate Burger Franchising

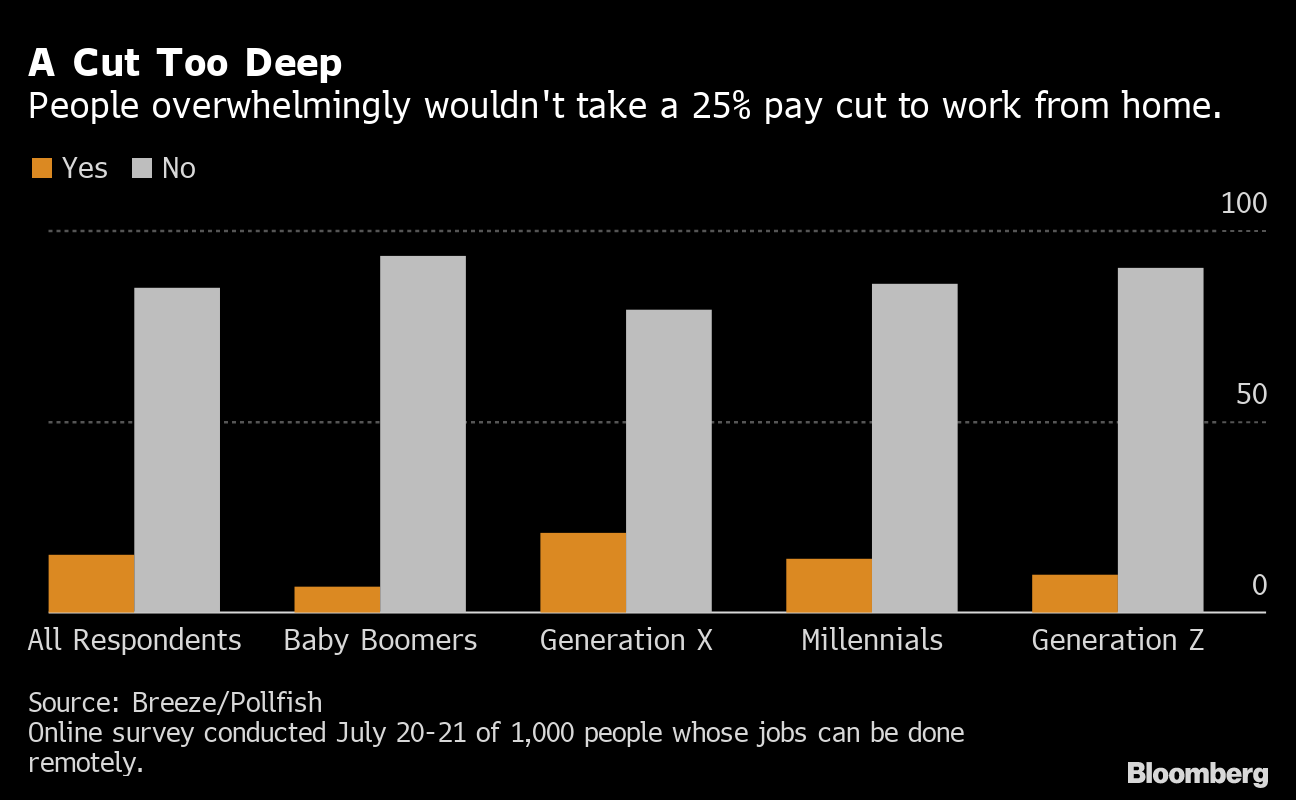

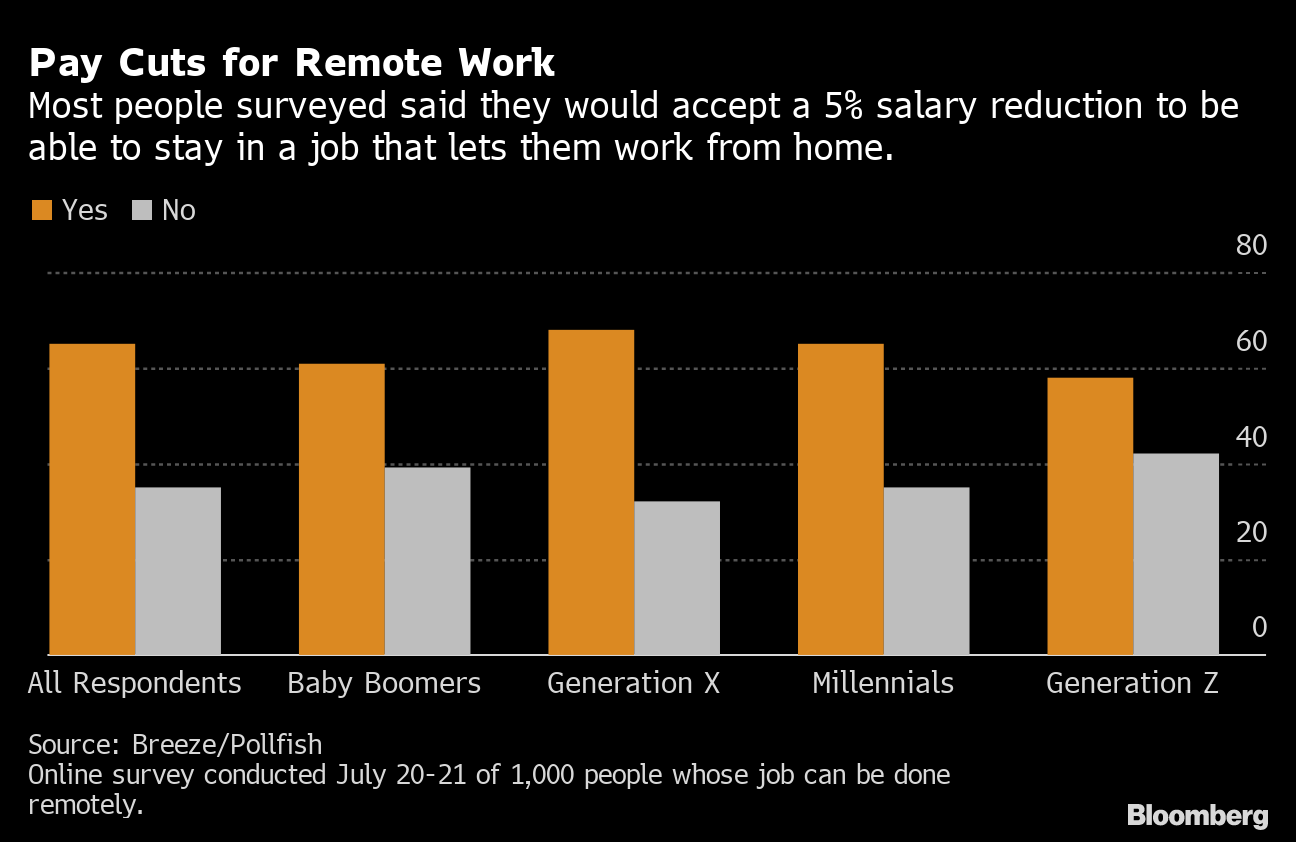

Return To Work Americans Willing To Take Pay Cut To Never Go Back To The Office Bloomberg

Fully Remote Worker Income Tax Withholding Considerations Rkl Llp

Cleaner Maid Service Housekeeping Cleaning Domestic Worker Png Art Carpet Cleaning Cartoon Cleaner C Maid Service Housekeeping Maid Service Cleaning Maid

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

The Most And Least Tax Friendly Major Cities In America

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Suburban Workers Reprieve From City Wage Tax Is Ending

Flat Rate Home Office Work From Home Deduction For 2021 And 2022 R Personalfinancecanada

Return To Work Americans Willing To Take Pay Cut To Never Go Back To The Office Bloomberg

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

Philadelphia Property Assessments Pandemic And Progressives Fueling Debate Over Taxes

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

Places With The Highest And Lowest Income Tax Rate And Take Home Salary Bloomberg

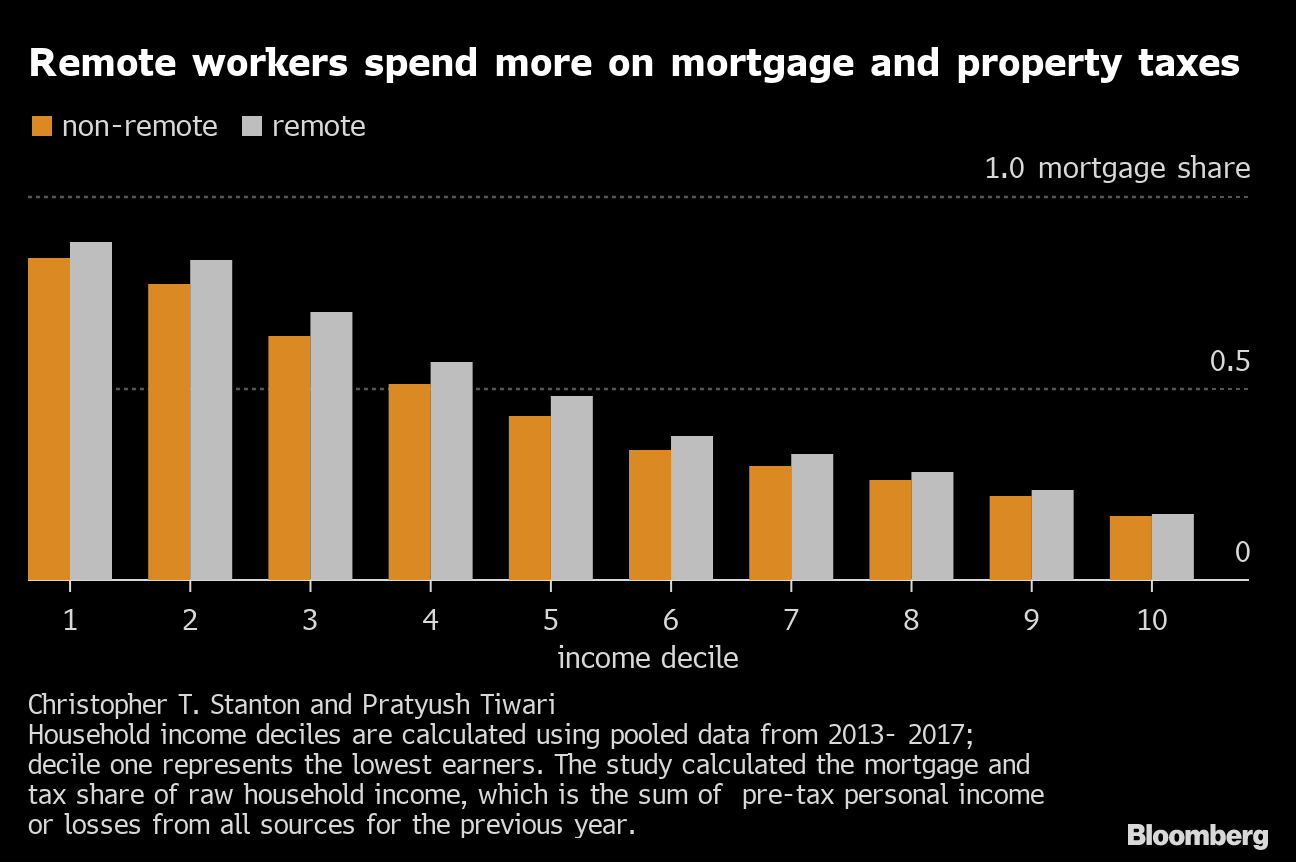

Why Remote Workers Spend More On Housing And Rent Bloomberg

Working From Home Isn T A Free Company Benefit Bloomberg

Will States Come Together To Resolve Remote Work Tax Withholding Issues Or Will We Continue Waiting Here On The Long And Winding Road Employment Law Spotlight

Flat Rate Home Office Work From Home Deduction For 2021 And 2022 R Personalfinancecanada